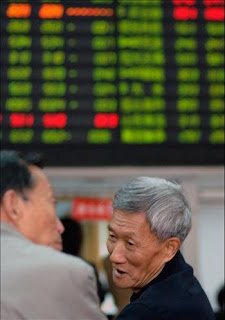

China Market Strategy - Chinese Stocks Collapse

By Guneet Singh Sahni - China Market Analyst

Wall Street Greek and Market Moving News cover all economic reports daily. Please visit the sites' front pages to see current data and analysis.

The CSI 300 Index plunged 8.8%, as the Chinese Government abstained from announcing any new growth measures to boost the markets before the Olympics. The markets were expecting some more loosening of economic policies to help boost the manufacturing sector.

Article interests (AMEX: DIA, SPY, SDS, DOG, QLD), Nasdaq: QQQQ, NYSE: NYX, Nasdaq: ASIA, Nasdaq: PRASX, AMEX: PUA, AMEX: NWD, Nasdaq: MEAFX, Nasdaq: EBASX, Nasdaq: EVASX, Nasdaq: MACSX, Nasdaq: MATFX, AMEX: CZJ, Nasdaq: CHINA, PCX: FXI, PCX: CYB

In an indication of slowing growth earlier this week, Bloomberg's consensus estimate predicts China’s trade surplus declined 17% Y/Y, to $20.3 billion for the month of July. This will be the fourth straight quarterly fall for an economy whose growth is dependent on exports. In an earlier indication of ailing growth, GDP growth eased to 10.1% Y/Y for second quarter. On the other hand, China is concerned about the overheating of its economy as unwanted foreign capital inflows find their way in, swelling currency reserves to $1.8 trillion.

Fight against slowdown....

Regulators raised tax rebates on exports of textiles and garments from 11% to 13% this month. The purpose of the move was to aid manufacturers in their fight against rising labour and raw-material costs. China has also halted the appreciation of the yuan, and increased bank lending quotas to levels in line with recently announced policy for robust growth. This leads the Government to provide an optimistic growth outlook for the third quarter.

As per China's state information center, GDP growth may accelerate to 10.2% in the third quarter, as industrial production quickens and the Sichuan province rebuilds post the May 12 earthquake. GDP growth was sapped in the first half by the effects of snowstorms and the nation's worst earthquake in 58 years, according to the report.

Moderating Inflation

Inflation for the month of July has shown signs of cooling off by increasing 6.5%, the slowest pace in seven months. Inflation has moderated from 7.1% in June and its 12-year high of 8.7% in February. According to China Securities Journal, inflation will slow to 6.6 % in the coming month. Inflation figures will be announced on the 12th of August. The government's 2008 inflation target is 4.8%.

Curbing Capital Flows

The government wants to prevent appreciation of the yuan and interest rates at their highest since 1998 from stoking investment flows and fueling inflation. Consequently, Chinese regulators approved new rules last week to curb illegal inflows of capital. The new rules will increase the authority of regulators to check transaction documents and bank-account information for currency payments. The rules also simplify approvals of outbound investments and ease capital raising in China by foreign companies. The authorities have also set up an electronic network to monitor export income, in order to stop speculators using bogus contracts to bypass investment rules.

Full Disclosure: Mr. Sahni has agreed to Wall Street Greek policy to not author articles about securities he personally owns or holds beneficial interest in. In the event of a special case, Guneet will make full disclosure of ownership interest. The work of contributors to Wall Street Greek is their own, and may not necessarily agree with the opinion of the site or its founder, and does not constitute financial advice. Please see our full disclosure at the site (Wall Street Greek).

0 Comments:

Post a Comment

<< Home