Apple (Nasdaq: AAPL) - December Seasonal Swing Offers Opportunity

Apple (Nasdaq: AAPL) shares have sold off in concert with the market to start December, but don’t throw your Apple shares out with the bathwater now. Apple shares have exaggerated the market’s decline, and I find it ironic considering the value proposition Apple’s shares still offer versus the market. I believe the selloff is due to seasonal factors that are about to shift in our favor. So, I suggest investors not rush to sell in panic, but rather consider the decline a new opportunity to add Apple shares to holdings.

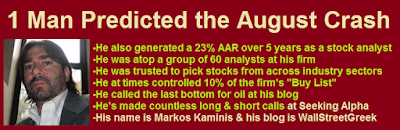

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

As I showed in my report about December seasonality, the month has historically outperformed all others. Since 1950, stocks have averaged a 1.6% gain in December; that is the best monthly performance. Yet, the first half of the month has produced less predictable and somewhat conflicted results. Over the last 10 years, the S&P 500 Index has only risen 0.2% on average from December 1st through the 15th of the month. It seems much of its gains come in the second half of the period. The traditional Santa Claus Rally does not run until the week between Christmas and New Year’s.

A few months back, I said Apple (Nasdaq: AAPL) shares would prove to be a good flight to quality destination. In the months that followed and through October when the market swooned, Apple remained a stalwart stock. However, the same reliability is not reflected in this month’s price action. The S&P 500 Index was off about 1.4% month-to-date through early AM trading on December 9th, yet Apple shares were down 6.5% for the month at that point. Interestingly enough, both Apple and the market on the whole seemed to be already turning around into the late afternoon trade. At some point before long this month, I expect Apple should resume its impressive trend line higher with conviction.

The S&P 500 Index (NYSE: SPY) trades at 19.9X trailing twelve month earnings, versus Apple’s relative P/E discount of 17.5X. Apple today is still a value at just 14.6X the analysts’ EPS consensus estimate of $7.76 for fiscal 2015 (Sept.). Apple pays a dividend yield of 1.6% here, and analysts estimate earnings growth of 20% this year. The five-year estimate for EPS growth is likely understated, as analysts are still unable to make sense of the company’s opportunity with Apple Pay and other efforts. Analysts see long-term growth at 11.5%, giving the company a PEG ratio of approximately 1.26X. When incorporating the dividend yield, I come up with a KPEG of 1.1X. That’s a value opportunity for the growth and dividend being offered, especially considering I think growth is understated.

The December seasonal selloff will soon turn to rally in my view, so I would use this opportunity to buy Apple shares on sale. Apple’s shares are up 44% year-to-date after adjusting for dividends and splits. That is significant appreciation since I recommended the shares at the start of the year. On January 2nd, I said Apple could unlock 68% upside value nearly overnight if it were to present new innovation, which it clearly has this year. The stock trades a little higher now than the average low point of its historical P/E range, but it has a long way to go to get to its recent history’s average high P/E ratio in the mid-20s. I talk about this in this 2012 report answering the question, Should I Buy Apple. Apple has clearly been a buy idea for me for years, and it is ever more appealing now that it is on sale. As I follow Apple somewhat regularly, readers may have interest in following my column.

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Apple (Nasdaq: AAPL)

As I showed in my report about December seasonality, the month has historically outperformed all others. Since 1950, stocks have averaged a 1.6% gain in December; that is the best monthly performance. Yet, the first half of the month has produced less predictable and somewhat conflicted results. Over the last 10 years, the S&P 500 Index has only risen 0.2% on average from December 1st through the 15th of the month. It seems much of its gains come in the second half of the period. The traditional Santa Claus Rally does not run until the week between Christmas and New Year’s.

A few months back, I said Apple (Nasdaq: AAPL) shares would prove to be a good flight to quality destination. In the months that followed and through October when the market swooned, Apple remained a stalwart stock. However, the same reliability is not reflected in this month’s price action. The S&P 500 Index was off about 1.4% month-to-date through early AM trading on December 9th, yet Apple shares were down 6.5% for the month at that point. Interestingly enough, both Apple and the market on the whole seemed to be already turning around into the late afternoon trade. At some point before long this month, I expect Apple should resume its impressive trend line higher with conviction.

The S&P 500 Index (NYSE: SPY) trades at 19.9X trailing twelve month earnings, versus Apple’s relative P/E discount of 17.5X. Apple today is still a value at just 14.6X the analysts’ EPS consensus estimate of $7.76 for fiscal 2015 (Sept.). Apple pays a dividend yield of 1.6% here, and analysts estimate earnings growth of 20% this year. The five-year estimate for EPS growth is likely understated, as analysts are still unable to make sense of the company’s opportunity with Apple Pay and other efforts. Analysts see long-term growth at 11.5%, giving the company a PEG ratio of approximately 1.26X. When incorporating the dividend yield, I come up with a KPEG of 1.1X. That’s a value opportunity for the growth and dividend being offered, especially considering I think growth is understated.

The December seasonal selloff will soon turn to rally in my view, so I would use this opportunity to buy Apple shares on sale. Apple’s shares are up 44% year-to-date after adjusting for dividends and splits. That is significant appreciation since I recommended the shares at the start of the year. On January 2nd, I said Apple could unlock 68% upside value nearly overnight if it were to present new innovation, which it clearly has this year. The stock trades a little higher now than the average low point of its historical P/E range, but it has a long way to go to get to its recent history’s average high P/E ratio in the mid-20s. I talk about this in this 2012 report answering the question, Should I Buy Apple. Apple has clearly been a buy idea for me for years, and it is ever more appealing now that it is on sale. As I follow Apple somewhat regularly, readers may have interest in following my column.

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: AAPL, Editors_Picks, Editors-Picks-2014-Q4, Stocks, Stocks-2014-Q4

0 Comments:

Post a Comment

<< Home