The data has continued to show up positive for the real estate relative stocks, but the current week provides an important event that should drive volatility in the group. Which way the stocks move depends entirely on the Federal Reserve and whether it begins to taper back asset purchases or not. So what should investors in these stocks do? They should do the same thing I’ve been telling them to do for some time now, and avoid the sexy near-term catalyst for trade, save for the very speculative investors, who may bet on volatility.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Real Estate Stocks

First a Look at Last Week

Real estate relative stocks had a relatively tough week last week, but it started out well enough. The path of the group ended up in about the same place as the broader market by the close of the week, but it took a wild ride to get there. The reason for it all was the same, trepidation about this week’s Federal Open Market Committee (FOMC) monetary policy meeting and the possibility of tapering of

Federal Reserve asset purchases.

The economic data was positive for real estate relatives last week, just like the week before. There were no major regular economic data points published, save the Mortgage Bankers Association’s

Weekly Applications Survey, which showed an increase in activity that followed the holiday period lull that preceded it. Because of that calendar impact and despite the seasonal adjustments made by the MBA, and given the time of year generally, I do not think you should follow this data point too closely now.

The

Retail Sales Report for November was published last week, and it offered some evidence of strength for the real estate sector. Within the report, we saw a 1.8% month-to-month and 5.3% yearly increase in the sales of building materials stores. Also, furniture and home furnishing stores marked 1.2% monthly and 9.7% yearly growth in November. Peter Lynch taught that activity in the housing industry would trickle down to the Home Depot’s (NYSE: HD) and Pier 1 Imports (NYSE: PIR) of the world. That seems to be happening, and offers reason enough to keep buying stocks like these. I expect in this case, this data offers support for continued growth in housing as well, due to the slow slug recovery in process and the distance it still has to go. There’s just one problem, though, and it could come into play this week.

This Week

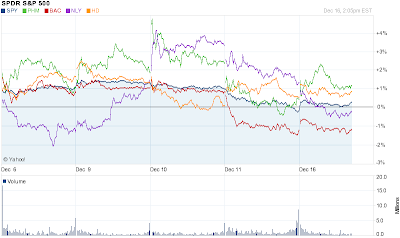

As you can see by the movement of the SPDR S&P 500 ETF (NYSE: SPY), stocks generally took a dive starting on last Tuesday, when the media and investors seemed to refocus toward this week’s FOMC monetary policy meeting and announcement. The coming meeting will include the quarterly forecasts of the Fed along with the chairman’s press conference, so it’s a big one. Perhaps then, given the steady flow of improved economic data over the last several weeks, it might also include the beginning of Fed tapering back of asset purchases. That’s something investors, especially those invested in real estate relative stocks, have high concern about.

If the FOMC does announce a slowing or ending of asset purchases this week, despite the long anticipated event, I expect interest rates will rise nonetheless. As that occurs, mortgage rates should also increase. Some would suggest that such an occurrence would drive a near-term boost in the real estate market, and that did occur over the last few months in my view. However, considering the time of year, and the nastiness of the weather so far (winter has not even begun yet), I do not see that happening over the next few months.

What this means for real estate stocks is a tapering of capital investment in them, and probably selling in most of the group. Bank of America (NYSE: BAC), the nation’s most important mortgage lender, should likewise be impacted. Banks benefit from the steepening of the yield curve, but those operating heavily in housing will see special drag from any impact high mortgage rates could have.

I expect the home builders like PulteGroup (NYSE: PHM) will have a spring season slowed a bit by higher rates, but much of this hinges on just how robust the economy really is. If the taper is coming for good reason, then higher rates might still be affordable for an increasingly employed nation.

As far as the mortgage REITs are concerned, I believe that while the share prices may dip along with the rest of the group this week, such a decline would represent a buying opportunity if recent economic trends hold. The market may understand this finally, given Annaly Capital’s (NYSE: NLY) gains last week, which contrasted against the decline of the group and market. Less competition for asset purchases means better pricing for buyers like Annaly and American Capital Agency (Nasdaq: AGNC). If housing continues to expand and the economy continues to improve, Annaly will operate in a better business all around, though still face higher costs of funding its operations on the way to normalcy.

So, in conclusion, the week ahead poses a threat to real estate relative stocks. However, if the Fed refrains from tapering, the party is on for the group this week. So what should investors bet on then? I would not put money to work at either end of the dangerous event, save perhaps a play on volatility, buying both call and put options. For the real estate stock investor, it’s been time to take money off the table for some time now. For real estate asset investors, it’s been time to buy property for some time now. That advice holds this week, in my view.

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Real-Estate, Real-Estate-2013-Q4, Real-Estate-Relative-Stocks, Real-Estate-Relative-Stocks-2013, Stocks, Stocks-2013-Q4