Support Disintegrates for Housing Stocks

Last week, we authored an article attributing the weekly decline in mortgage activity to the Super Bowl, and the tendency of Americans to celebrate the day like a holiday. We argued that, as with many three-day weekends, this would leave inadequate adjustment to business activity around the day. However, mortgage activity dropped again last week, for the period through February 17. Since the period fell between the Super Bowl and President’s Day, something more than anomaly is leading mortgage activity lower. This report, in fact, offers more evidence of the stall I’ve been warning about for housing, and so the hopeful support tenuously holding up the industry’s shares is now disintegrating rapidly.

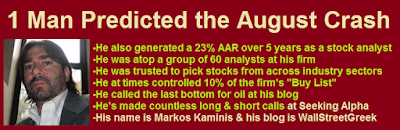

Last week, we authored an article attributing the weekly decline in mortgage activity to the Super Bowl, and the tendency of Americans to celebrate the day like a holiday. We argued that, as with many three-day weekends, this would leave inadequate adjustment to business activity around the day. However, mortgage activity dropped again last week, for the period through February 17. Since the period fell between the Super Bowl and President’s Day, something more than anomaly is leading mortgage activity lower. This report, in fact, offers more evidence of the stall I’ve been warning about for housing, and so the hopeful support tenuously holding up the industry’s shares is now disintegrating rapidly. Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.Housing Stocks Follow Our Lead Lower

The Mortgage Bankers Association’s Market Composite Index fell 4.5% in the week ending February 17. This week, the main driver of the dip in mortgage activity was a drop in refinancing, with the Refinance Index down 4.8%. There was some creep higher in mortgage rates, but not across the spectrum of mortgage loan sizes and types. I also do not see the creep in rates as enough to stymie activity. The effective rates on jumbo and conforming 30-year mortgages both edged slightly higher, while effective rates for 15-year mortgages and 5/1 ARMS also inched upward. Only 30-year FHA sponsored loans saw effective rate decrease, but the change was also insignificant.

The previous week’s driver of decline was a notable decline in the Purchase Index, or loans tied to the acquisition of properties. We were looking for a like, though opposing rise this week, as the period matched against the Super Bowl inclusive week. Yet, the Purchase Index fell again, this time by 2.9% on a seasonally adjusted basis. Before adjustment, the Purchase Index did improve, but only by 1.4% against the prior week. The gain fell short of making up for the 7.6% decline the week before, so we have to take note. That’s because other data has continued to warn of a stall in housing, which we covered in detail in our recent study of the sector.

Indeed, the latest data reported today seems to confirm that concern. The four-week moving average of the MBA’s Market Composite Index, which would weed out anomalous factors, is down 0.3%. The moving average for the Purchase Index is off a greater 3.21%. The latest data, also reported Wednesday morning, showed Existing Home Sales running at a drag of an annual pace of 4.57 million in January. The rate was up from December, but only after December’s revision dramatically lower, to 4.38 million (from 4.61 million). January’s pace was also short of the consensus view of economists, which was set at 4.69 million according to Bloomberg.

Toll Brothers (NYSE: TOL) missed expectations this week, contributing to a second guessing of homebuilder shares finally. We suggested investors sell short homebuilder shares earlier this year, and have been questioning the strength of a housing recovery based on macroeconomic developments that should stall global economic growth.

The SPDR Series Trust Homebuilders ETF (NYSE: XHB) is off about a percentage point at the hour of scribbling here, and looks to be ready to follow the path I’ve laid out for it now. Individual homebuilders are giving back greater ground, especially those which are in the most precarious of positions. The shares of Hovnanian (NYSE: HOV) and Comstock (Nasdaq: CHCI), two companies I suggested would lead my list lower, are off 0.7% and 3.6%, respectively. K.B. Home (NYSE: KBH), PulteGroup (NYSE: PHM) and D.R. Horton (NYSE: DHI) are off between 1% and 4%. It seems that investors are now agreeing with my argument against the industry, and so support should disappear swiftly for these stocks near-term. I would continue to sell the industry’s shares as their nascent recovery is undermined by fundamental macro-driven drivers.

Article should interest investors in Savings & Loan stocks including Alaska Pacific Bankshares (OTC: AKPB.OB), Allied First Bancorp (OTC: AFBA.OB), Astoria Financial (NYSE: AF), AMB Financial (OTC: AMFC.OB), Ameriana Bancorp (NasdaqCM: ASBI), Anchor Bancorp Wisconsin (Nasdaq: ABCW), Bancorp of New Jersey (AMEX: BKJ), Bank Mutual (Nasdaq: BKMU), BankAtlantic (NYSE: BBX), BankFinancial (Nasdaq: BFIN), Banner (Nasdaq: BANR), BCSB Bancorp (Nasdaq: BCSB), Beacon Federal (Nasdaq: BFED), Berkshire Hills (Nasdaq: BHLB), Blackhawk Bancorp (OTC: BHWB.OB), Blue River Bancshares (OTC: BRBI.OB), Bofi (Nasdaq: BOFI), Broadway Financial (Nasdaq: BYFC), Brookline (Nasdaq: BRKL), Brooklyn Federal (Nasdaq: BFSB), Camco Financial (Nasdaq: CAFI), Capitol Federal (Nasdaq: CFFN), Carver (Nasdaq: CARV), Cecil Bancorp (OTC: CECB.OB), Center Financial (Nasdaq: CLFC), Central Federal (Nasdaq: CFBK), Chicopee (Nasdaq: CBNK), Citizens South (Nasdaq: CSBC), CKF Bancorp (OTC: CKFB.OB), Clarkston Financial (OTC: CKFC.OB), Clifton Savings (Nasdaq: CSBK), Close Brothers (OTC: CBGPY.PK), Columbia Banking (Nasdaq: COLB), Consumers (OTC: CBKM.OB), Dime Community (Nasdaq: DCOM), Enterprise (Nasdaq: EBTC), ESB Financial (Nasdaq: ESBF), ESSA Bancorp (Nasdaq: ESSA), Eureka Financial (OTC: EKFC.OB), FedFirst Fin’l (Nasdaq: FFCO), FFD Fin’l (Nasdaq: FFDF), FFW (OTC: FFWC.OB), First Bancorp of Indiana (OTC: FBPI.OB), First Bancshares (Nasdaq: FBSI), First Capital (Nasdaq: FCAP), First Clover Leaf (Nasdaq: FCLF), First Defiance (Nasdaq: FDEF), First Federal Bancshares of Arkansas (Nasdaq: FFBH), First Financial Holdings (Nasdaq: FFCH), First Independence (OTC: FFSL.OB), First Investors Fin’l Services (OTC: FIFS.PK), First Niagara (Nasdaq: FNFG), First Robinson (OTC: FRFC.OB), First Security Group (Nasdaq: FSGID), First South (Nasdaq: FSBK), Flagstar (NYSE: FBC), Flatbush Federal (OTC: FLTB.OB), Flushing Financial (Nasdaq: FFIC), Greene County (Nasdaq: GCBC), HF Financial (Nasdaq: HFFC), HMN Fin’l (Nasdaq: HMNF), Home Bancorp (Nasdaq: HBCP), Home Federal (Nasdaq: HOME), HopFed (Nasdaq: HFBC), Hudson City (Nasdaq: HCBK), Indiana Community (Nasdaq: INCB), Investors Bancorp (Nasdaq: ISBC), Jacksonville Bancorp (Nasdaq: JXSB), Jefferson Bancshares (Nasdaq: JFBI), Kaiser Federal (Nasdaq: KFFG), Kearny Fin’l (Nasdaq: KRNY), Kentucky First Federal (Nasdaq: KFFB), Lake Shore Bancorp (Nasdaq: LSBK), Louisiana Bancorp (Nasdaq: LABC), LSB Fin’l (Nasdaq: LSBI), Malvern Federal (Nasdaq: MLVF), Meridian Interstate (Nasdaq: EBSB), Meta Fin’l (Nasdaq: CASH), NASB Fin’l (Nasdaq: NASB), Naugatuck Valley (Nasdaq: NVSL), New England Bancshares (Nasdaq: NEBS), New Hampshire Thrift (Nasdaq: NHTB), New York Community (NYSE: NYB), North Central Bancshares (Nasdaq: FFFD), Northeast Community (Nasdaq: NECB), Northwest Bancshares (Nasdaq: NWBI), OceanFirst (Nasdaq: OCFC), Ocwen (NYSE: OCN), Oneida (Nasdaq: ONFC), Park Bancorp (Nasdaq: PFED), Parkvale Fin’l (Nasdaq: PVSA), Pathfinder Bancorp (Nasdaq: PBHC), People’s United (Nasdaq: PBCT), Provident Community (Nasdaq: PCBS), Provident Fin’l (Nasdaq: PROV), Provident Fin’l Services (NYSE: PFS), Provident New York (Nasdaq: PBNY), Prudential Bancorp of PA (Nasdaq: PBIP), PSB Holding (Nasdaq: PSBH), Pulaski Fin’l (Nasdaq: PULB), PVF Capital (Nasdaq: PVFC), QC Holding (Nasdaq: QCCO), River Valley Bancorp (Nasdaq: RIVR), Riverview Bancorp (Nasdaq: RVSB), Roma Fin’l (Nasdaq: ROMA), Salisbury Bancorp (AMEX: SAL), SI Financial (Nasdaq: SIFI), Southern Missouri (Nasdaq: SMBC), Sterling Fin’l (Nasdaq: STSA), Teche Holding (AMEX: TSH), TF Fin’l (Nasdaq: THRD), Timberland Bancorp (Nasdaq: TSBK), United Community (Nasdaq: UCBA), United Community Fin’l (Nasdaq: UCFC), United Fin’l Bancorp (Nasdaq: UBNK), Valley Fin’l (Nasdaq: VYFC), Washington Federal (Nasdaq: WFSL), Waterstone Fin’l (Nasdaq: WSBF), Wayne Savings (Nasdaq: WAYN), WSB Holdings (Nasdaq: WSB) and WVS Financial (Nasdaq: WVFC).

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Editors_Picks, Editors-Picks-2012-02, INDUSTRY-Homebuilders, Real-Estate, Real-Estate-2012-02

0 Comments:

Post a Comment

<< Home